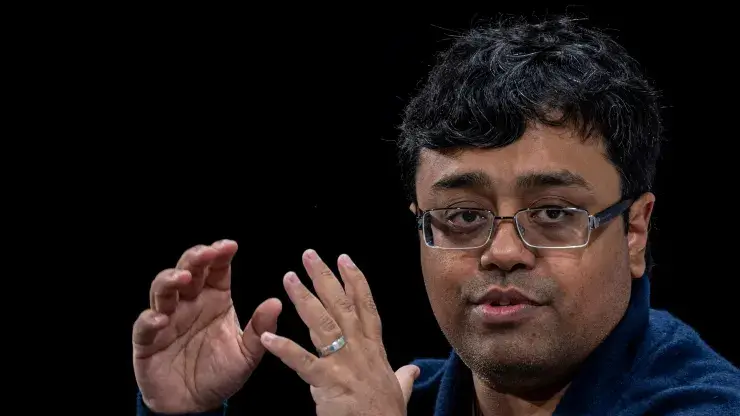

According to Stability AI CEO Emad Mostaque, artificial intelligence (AI) will become the biggest bubble in history. In a recent call with UBS analysts, Mostaque expressed his belief that the AI industry, which he refers to as the “dot AI” bubble, is still in its early stages and not yet ready for widespread adoption in sectors like banking.

Stability AI, the company behind Stable Diffusion, a popular generative AI tool, has garnered significant attention in the field. Stable Diffusion allows users to generate realistic images based on text inputs and has attracted over a million users and more than $100 million in funding from investors such as Coatue and Lightspeed Venture Partners.

However, it is worth noting that Mostaque has faced allegations of making misleading claims about his background, achievements, and partnerships. He has addressed these allegations individually on his personal blog, refuting them in detail.

Generative AI, which can produce humanlike language and visual content based on user prompts and vast amounts of data, has captured the imagination of academics, executives, and even students. While AI technology has been present for some time, generative AI tools like ChatGPT, Google Bard, Microsoft Bing Chat, Dall-E, Stable Diffusion, and Midjourney have gained prominence more recently.

AI has found applications in various domains, including online browsing, social media platforms, home assistants, medicine, transportation, robotics, science, education, finance, defense, and others.

Mostaque believes that the total investment required for AI will likely reach $1 trillion, as he sees it as crucial infrastructure for knowledge, even surpassing the importance of 5G technology. He suggests that banks and financial institutions like UBS will have to adopt AI due to its immense market potential.

However, Mostaque acknowledges that AI is currently in its early developmental stages and not yet prepared for large-scale deployment in industries like financial services. Despite this, he emphasizes the value of AI and warns that companies failing to utilize it effectively in their businesses will face consequences in the stock market.

He highlights the example of Google, which experienced a $100 billion loss in market value after its Bard AI chatbot provided inaccurate information in a promotional video. Google is actively competing with Microsoft in the race to develop superior AI tools.

Mostaque asserts that AI is a real and significant investment theme in the coming years. He believes that few investment opportunities exist in this space and predicts a shift from investing in chip manufacturers to companies leveraging AI to impact their bottom and top lines. He suggests that the market will penalize those who fail to leverage AI appropriately.

In conclusion, while the opinions expressed by Stability AI CEO Emad Mostaque may raise awareness about potential risks and challenges associated with the AI industry, it is important to consider multiple perspectives and ongoing developments in the field. The impact of AI, its future trajectory, and its potential bubble-like characteristics remain subjects of debate and require careful observation as the technology continues to evolve.