In the wake of a market rout that engulfed tech stocks last year, the tech industry’s prominent players have managed to rebound in 2023. However, among them, Nvidia has truly outshone its peers. Fueled by its substantial head start spanning over a decade in the realm of artificial intelligence chips and software—a segment that has now become immensely sought-after throughout Silicon Valley—Nvidia has witnessed an impressive 180% surge in its shares this year. This staggering growth surpasses the performance of every other constituent of the S&P 500. The next closest gainer in the index is Meta, the parent company of Facebook, which boasts a 151% increase in share value as of Friday’s closing.

Nvidia’s valuation has soared to over $1 trillion, elevating it to the fifth spot among the most valuable U.S. companies, trailing only the colossal tech giants: Amazon, Apple, Microsoft, and Alphabet.

Despite not being as widely recognized as its mega-cap tech counterparts, Nvidia’s foundational technology plays a pivotal role in powering the latest cutting-edge product that has the potential to disrupt various sectors, including education, media, finance, and customer service. This revolutionary force is none other than ChatGPT.

OpenAI’s ChatGPT, the viral chatbot generously funded by Microsoft, along with AI models from a handful of well-funded startups, all heavily rely on Nvidia’s graphics processing units (GPUs) for their operation. Nvidia’s GPUs are widely acclaimed as the premier choice for training AI models, and the company’s financial forecasts indicate a seemingly insatiable demand.

Nvidia’s robust H100 chips, priced at around $40,000 each, have been rapidly adopted by giants like Microsoft and OpenAI, procuring them by the thousands. According to Harsh Kumar, an analyst at Piper Sandler, “Long story short, they have the best of the best GPUs, and they have them today.”

However, beneath this momentum and apparent unquenchable demand lies a multitude of assumptions about Nvidia’s future growth. These assumptions encompass a projection of sales doubling in the upcoming quarters and net income nearly quadrupling within the current fiscal year.

Critics argue that Nvidia’s stock has been priced for perfection, and a glance at its price-to-earnings (P/E) ratio reinforces this view. Over the last 12 months, Nvidia’s P/E ratio stands at a staggering 220, a figure notably higher even than notoriously high-valued tech enterprises like Amazon and Tesla.

If Nvidia manages to fulfill analysts’ predictions, the current stock price may seem more reasonable, albeit still relatively high compared to much of the tech sector. Based on projections for the next 12 months of earnings, Nvidia’s P/E ratio is anticipated to be 42, while Amazon and Tesla carry P/E ratios of 51 and 58, respectively.

As Nvidia approaches its upcoming earnings report, market analysts anticipate quarterly revenue of $11.08 billion, marking a remarkable 65% surge from the previous year. This projection slightly surpasses Nvidia’s official guidance of around $11 billion.

Investors are banking on Nvidia’s ability to sustain its success beyond the immediate quarter, outlasting growing competition from the likes of Google and AMD while avoiding substantial supply issues.

Nonetheless, the remarkable ascent of Nvidia’s stock also invites concerns associated with rapid and excessive growth. In the recent week, Nvidia’s stock experienced a steep 8.6% drop, a significant contrast to the Nasdaq’s mere 1.9% decline. Curiously, there was no negative news to justify such a plummet. This downturn constitutes Nvidia’s sharpest weekly decline since September of the previous year.

WisdomTree analyst Christopher Gannatti voiced the sentiment shared by some investors: the notion that the company’s remarkable achievements and future prospects might already be fully accounted for in its performance. High investor expectations, as Gannatti notes, often pose a formidable challenge for companies.

While Nvidia’s stock rally in the current year is undoubtedly impressive, a more jaw-dropping narrative emerges when observing its 10-year trajectory. A decade ago, Nvidia was a relatively modest entity valued at roughly $8.4 billion, only a fraction of the market cap held by chip giant Intel.

In the ensuing years, while Intel’s stock rose by 55%, Nvidia’s worth has ballooned by an astonishing 11,170%, rendering it seven times more valuable than its competitor. Even Tesla, responsible for propelling CEO Elon Musk to the position of the world’s wealthiest individual, has seen its stock soar by 2,279%.

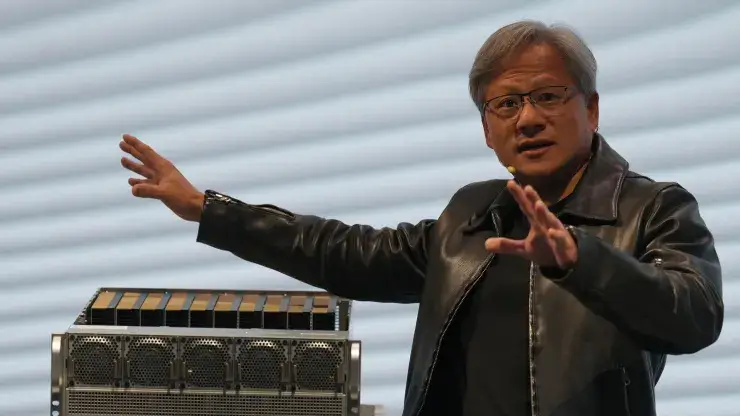

Nvidia’s founder and CEO, Jensen Huang, has witnessed his net worth swell to a substantial $38 billion, positioning him as the 33rd richest individual on the Bloomberg Billionaires index.

It’s worth noting that prior to the advent of AI, Nvidia had established itself as a key player in video game technology. Founded in 1993, the company’s processors played a pivotal role in enabling gamers to experience intricate graphics in computer games. One of its iconic products was the graphics card—chips and boards integrated into consumer PC motherboards and laptops.

While video games still constitute a significant aspect of Nvidia’s business, the company reported a decline of 27% in gaming sales for fiscal year 2023. This downturn can be attributed, in part, to a surge in graphics card sales during the early stages of the pandemic, when individuals were upgrading their home systems. Consequently, Nvidia’s core gaming business has experienced a continued contraction.

However, the aspect that truly excites Wall Street is not gaming, but Nvidia’s burgeoning AI business, primarily housed under the data center segment. This division saw a remarkable 41% surge in sales to reach $15 billion in the preceding year, surpassing gaming revenues. Market analysts polled by FactSet anticipate this segment to more than double, reaching $31.27 billion in fiscal year 2024. Remarkably, Nvidia commands over 80% of the AI chip market, according to experts.

Nvidia’s pivot towards AI chips has been a long-evolving process spanning 15 years. In 2007, the company introduced a relatively inconspicuous software package and programming language named CUDA. This tool enabled programmers to leverage the complete hardware capabilities of GPU chips. Over time, CUDA gained traction as an effective tool for training and running AI models, effectively becoming an integral aspect of the training process.

When AI companies and developers utilize Nvidia’s GPUs and CUDA to construct their models, they become less inclined to transition to competitors, such as AMD’s chips or Google’s Tensor Processing Units (TPUs). As Patrick Moorhead, a semiconductor analyst at Moor Insights, suggests, Nvidia has established a double moat—superior performance training hardware coupled with indispensable software libraries in the AI domain.

As Nvidia’s valuation has surged, the company has adopted measures to solidify its dominance and meet the lofty expectations. Notably, Nvidia’s founder Huang engaged in a dinner meeting with Morris Chang, the chairman of Taiwan Semiconductor Manufacturing Co. (TSMC). TSMC, a leading chip manufacturer catering to semiconductor companies, produces Nvidia’s key products. Following the dinner, Huang expressed confidence in the partnership, implying that Nvidia had secured its essential supply chain.

Furthermore, Nvidia has emerged as a substantial investor in the startup ecosystem, focusing on companies that operate in conjunction with AI models. In 2023 alone, Nvidia has invested in at least 12 startups, including prominent names in the AI domain such as Runway, Inflection AI, and CoreWeave. These investments serve a dual purpose