The United States is striving to contain China’s advancement in chip technology, but a startup in China, led by a Silicon Valley veteran, is proving the challenge won’t be easily met. This company, SEIDA, emerged with bold plans to offer microchip design software crucial for creating advanced chips, a tool largely controlled by Western giants.

SEIDA aimed to break the foreign monopoly on this indispensable technology, pitching itself as a key player in China’s quest for self-reliance in chip tech. Their ambitions drew significant support, including backing from China’s leading chipmaker, SMIC, despite U.S. restrictions limiting American companies from engaging with SMIC due to security concerns.

However, SEIDA’s journey has taken intriguing turns. While initially planning to sell the software, recent developments suggest a shift in their objectives. The company’s spokespeople emphasized evolving plans and an investor landscape primarily composed of private entities.

The startup’s genesis, led by former Siemens EDA employees, reflects a common strategy among Chinese firms—leveraging foreign expertise. Although no wrongdoing is alleged, experts suggest that creating such sophisticated technology from scratch, especially in a short timeframe, without drawing from existing knowledge, is exceedingly challenging.

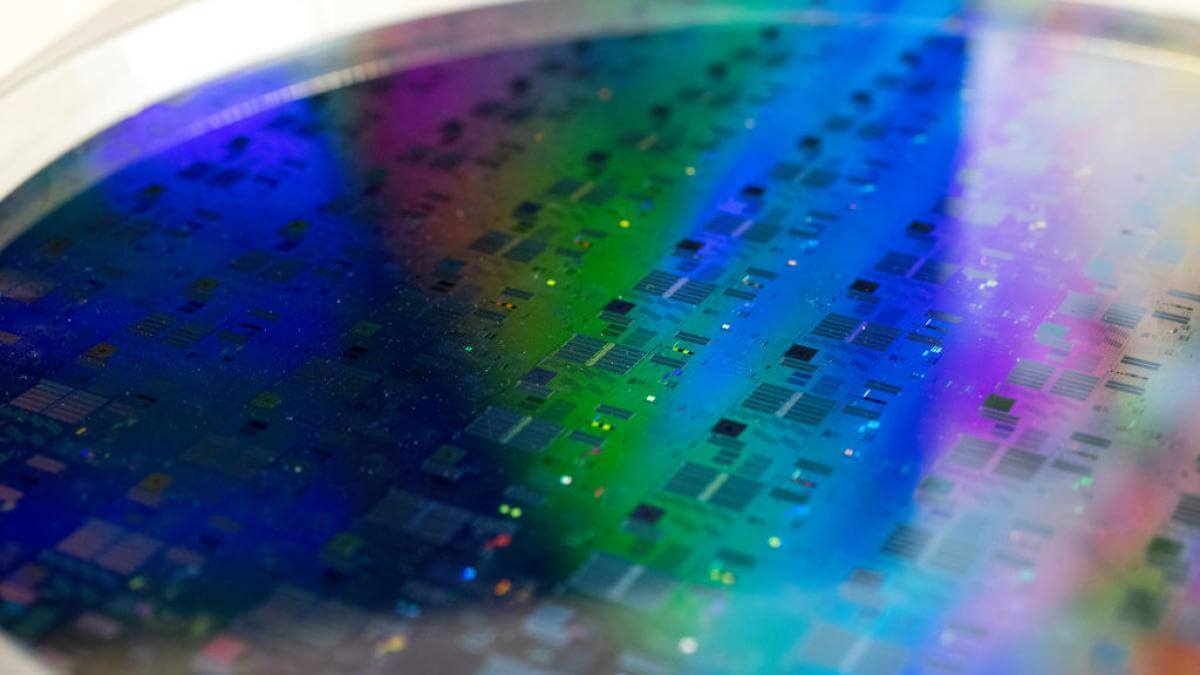

The battle between the U.S. and China over chip technology intensifies, with Washington imposing stringent export controls to impede China’s access to crucial Electronic Design Automation (EDA) tools. These tools are vital for designing chips pivotal to groundbreaking technologies like AI, quantum computing, and hypersonic flight.

China’s aggressive push for chip advancement, backed by substantial government investments and programs like “Thousand Talents,” aims to attract skilled professionals from abroad. This drive is met with U.S. skepticism, given concerns about intellectual property theft.

The global semiconductor industry’s interconnectivity poses hurdles for the U.S. in curtailing China’s access to technology, unlike past efforts against the Soviet Union. While the U.S. leads in chip design technologies, manufacturing largely occurs in Asia, highlighting the challenge in limiting China’s advancements.

Despite export controls, China continues to make strides in chip technology. Recent cases involving Chinese companies using restricted U.S. technologies showcase the complexities of tracking technology origins and controlling intellectual property in a rapidly evolving industry.

SEIDA’s emergence, typical of numerous Chinese tech startups, underscores Beijing’s push for a stronger domestic semiconductor industry. However, specific details about the startup’s inception and government involvement remain challenging to ascertain due to recent changes in Chinese regulations.

SEIDA’s journey is emblematic of the larger battle for dominance in chipmaking, crucial in determining the future of various technological sectors. The collision between the U.S. and China in this domain signifies the limits of export controls in an interconnected global industry.