On August 21st, Palo Alto Networks (PANW.O) experienced a remarkable surge of 12% in its stock value, eliciting positive reactions from investors. This surge was primarily attributed to its dominant position within the cybersecurity market, which in turn contributed to a robust forecast for the company. The choice of a less conventional summer Friday for its earnings announcement had initially sparked concerns of potential weakness, yet the strong projection dispelled those worries.

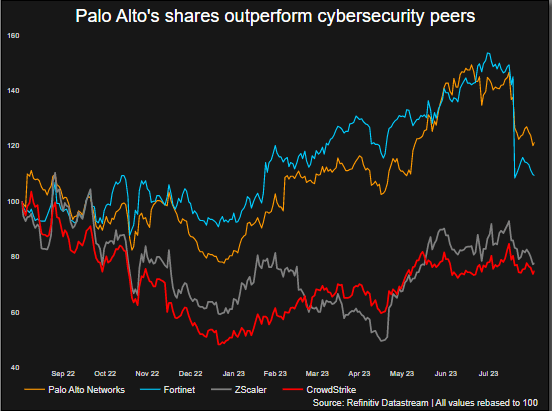

Notably, competitors in the same sector, namely CrowdStrike Holdings (CRWD.O) and Fortinet (FTNT.O), also witnessed a positive impact on their stock prices, rising by 3.2% and 1.5% respectively in response to Palo Alto’s earnings report. This was particularly noteworthy given that Palo Alto Networks had faced a decline of nearly 17% in the period leading up to its earnings announcement earlier that month.

Wedbush Securities analysts underscored the significance of Palo Alto’s performance, noting that amidst apprehension due to the Friday afternoon release and the uncertain macroeconomic backdrop, the company delivered a comparatively strong quarterly report.

One of the pivotal highlights of the report was Palo Alto Networks’ projection of full-year billings, which were forecasted to range between $10.9 billion and $11.0 billion. This exceeded the consensus estimate of $10.80 billion, prompting a notable response from the investment community. In fact, at least 14 brokerages chose to upgrade their stock ratings in light of these optimistic projections.

The general sentiment before Palo Alto’s earnings release had been one of cautious expectations, largely influenced by Fortinet’s earlier indications of softening demand for core firewall products within the sector, causing a broader selloff. However, the increasing tightening of enterprise budgets coupled with the escalating threat landscape of cyber attacks has led more businesses to gravitate towards major players like Palo Alto Networks. These industry leaders are increasingly perceived as comprehensive solutions providers for a diverse array of cybersecurity needs.

Confidence in Palo Alto’s ability to consolidate enterprise security spending and to outperform its peers while maintaining robust profitability was emphasized by RBC Capital Markets analysts. This perspective aligned with the belief that the integration of generative AI into enterprise workflows would be a positive force for the cybersecurity sector, enhancing the overall effectiveness of security platforms.

J.P. Morgan analysts speculated that the emergence of next-generation cloud technologies, data analytics, and AI has laid the groundwork for well-structured platforms to yield outcomes greater than the sum of their individual components. This insight highlighted the promising potential of these technological advancements for the cybersecurity industry.

In terms of valuation, Palo Alto Networks was trading at more than 41 times the consensus earnings projected for the next 12 months. In comparison, CrowdStrike stood at 52.56 times and Fortinet at 34.19 times. This demonstrated the market’s confidence in Palo Alto’s future prospects, further contributing to the company’s recent positive stock performance.

Palo Alto Networks’ strong earnings report and optimistic forecast led to a significant uptick in its stock value, causing a ripple effect in the broader cybersecurity sector. The company’s ability to maintain its market dominance, capitalize on emerging technologies, and provide holistic solutions in the face of evolving cybersecurity challenges garnered positive attention from analysts and investors alike.